Beginning a business can be costly and the same goes to making sure it continues to run. Regardless of where you are in your business’ life cycle, from startup to development, getting a business loan can assist with a lot of situations you may find your business to be in.

Getting business loans play an essential part of the business world since entrepreneurs depend on them to put resources into new hardware or supplies, cover finance, or oversee income while they trust that clients or customers will pay. With an independent business loan, entrepreneurs and business visionaries can get a singular amount of money or a credit extension, which they can use to stay functional and keep developing their business for a really long time in the future.

Curiously, the best small business loans accessible today are presented by online loan specialists and not by conventional banks. This is because of the way that, all things considered, online moneylenders can offer the most advantageous application and subsidizing processes alongside aggressive expenses and the best advance terms.

Business loans come in many structures today, from “unstable business advances” that give quick, transient subsidizing to make the most of a chance, to a “momentary business advance” to cover a deficiency. There are more business loan choices to consider than the standard business advances the banks offer. Getting a business loan can be utilized for any certifiable business reason as well, there aren’t any limitations. More than half of Australian independent companies have an advanced office of some description. Today, you don’t bring to the table any guarantee or security to get a business loan. With these, here are some ways on how to choose the best small business loans and ways in getting a business loan.

Get the full Payment Schedule

One more significant part of getting a business loan that all proprietors ought to comprehend is the various sorts of business loan financing costs advertised. In Australia, we have basically two distinct sorts of financing costs presented by banks and loan specialists: fixed rate and variable rate.

With a proper rate advance, your financing cost won’t change over the term of the business loan as it is already settled upon. With variable rate type, there is an implication that one can end up paying lower loan fees depending on the market changes. This rate type can also imply, however, that one can end up paying more if there are increments in the current market rate.

It is recommended that you apply for a proper rate advance, even a little expansion to your greatest advantage rate, if you somehow happened to settle on a variable rate advance, may cause an unforeseen cost for your business. Notwithstanding, assuming you feel that your business has the monetary security and dependability, and you can stand to bet on economic situations, a variable rate advance might just wind up setting aside your cash. Doing web exploration can assist you with understanding the best situation to take.

Be sure all your documentation is complete

Most Australian banks and larger monetary establishments will require independent companies to give a total field-tested strategy to getting a business loan. Much of the time, the documentation required may be exceptionally point by point, complete with exhaustive monetary projections.

Assuming your small business has all of that administrative work currently set up, then, at that point, furnishing an account with those archives shouldn’t be an issue. Assuming your small business doesn’t have a point by point field-tested strategy or on the other hand, on the off chance that a particular money lender is requesting more a more nitty gritty and comprehensive field-tested strategy, it very well may be smarter to look for a loan that requires less broad administrative work or Low doc business loan which are accessible from certain loan specialists.

A few moneylenders essentially expect you to finish up straightforward structures identified with the business and bookkeeping information associated with your field-tested strategy. These moneylenders make the method involved with getting an advance substantially less feverish and tedious for organizations on a tight timetable.

Get a business loan with no hidden fees and has upfront costs

Tragically, there are numerous small business loan specialists, loaning organizations, and surprisingly grounded banks that hope to exploit entrepreneurs. They realize that entrepreneurs, particularly when beginning another business, will in all probability confront specific financial difficulties that will leave them needing independent company subsidizing to get their business fully operational. They realize that giving admittance to assets will be exceptionally captivating.

Playing off this shortcoming, several moneylenders attempt to attract entrepreneurs with guarantees of best small business loans financing costs that they vigorously publicize.

High secret expenses, particularly on the off chance that you are requesting a limited quantity of cash, can really make the aggregate sum you take care of a lot higher than if you somehow happened to settle on a more straightforward small business loan with a higher financing cost, however no secret charges.

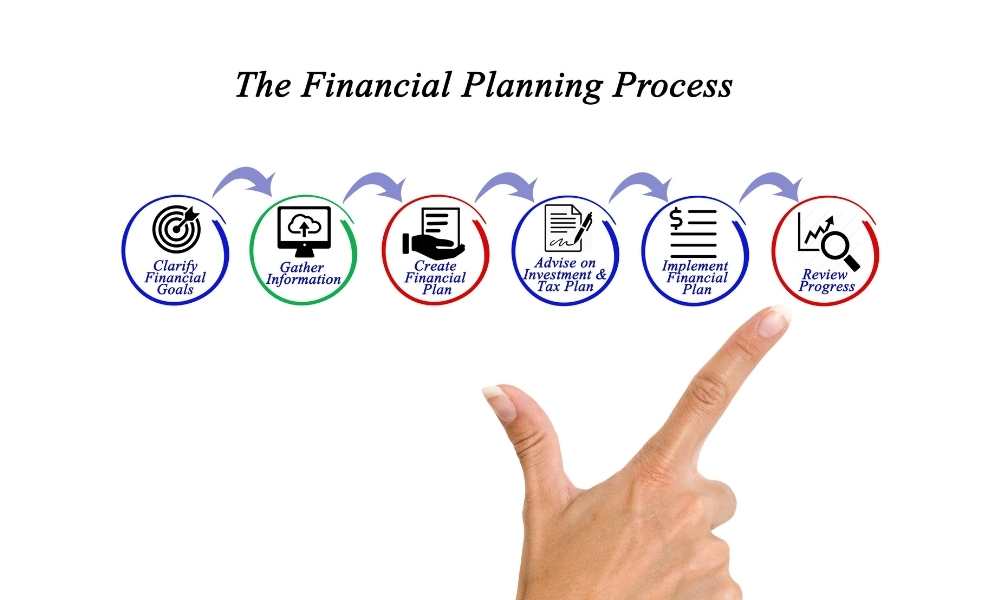

Make a Financial Plan just for paying off your loan

One of the main methodologies for monetary achievement, both for people and organizations, is knowing how to deal with your assets and your income. Once supported for getting small business loans, the moment the convergence of capital into your business can intermittently make monetary enticements use that cash in under ideal ways.

On top of the the fact that it is essential to create a financial plan and put forth a valiant effort to adhere to it, it is additionally a smart idea to ensure that you fully comprehend the conditions needed for you to take care of your advance inside the advance term on getting a small business loan.

Learning your Loan Interest Rate by heart is key

When entrepreneurs apply for a business loan, financing costs become a significant piece of their month to month outpourings until it gets completely reimbursed. Realizing the specific financing cost rate that the business can pay off can assist organizations with trying not to endanger the business’ benefits with exorbitant premium charges and expenses.

Borrowers should likewise remember that higher loan sums mean higher financing costs. While bigger advances can be exceptionally enticing for small businesses, consider whether the business can reliably reimburse these loans regardless of how high the financing costs might be—forestalling the chance of the business battling to take care of the loan’s exorbitant fees.

Decide on a loan amount and Stick to it

Settling on a loan sum goes connected at the hip with deciding the motivation to get one.

A great deal of loaning organizations have a variety of financing options for entrepreneurs, each small business loan choice custom fitted explicitly for a specific use. Getting a business loan additionally has fluctuating permissible acquiring sums and going with interest liabilities which entrepreneurs need to consider.

Entrepreneurs should take care to acquire just the specific sum expected to keep the business from getting overwhelmed with business loan reimbursements. This guarantees that getting a business loan is used distinctly for its illustrated reason.

Keep in mind the duration of the loan

On picking the best small business loan, new company moneylenders have fluctuating lengths of reimbursements with differing financing costs. The length of business loan reimbursements and its going with financing costs should likewise be considered by entrepreneurs while picking the right business advance.

In the wake of deciding the specific length required for the business to reimburse the loan, entrepreneurs should make a point to take out the advance just during the predetermined span.

Entrepreneurs ought to likewise make a point to take care of their advances on schedule. This forestalls any superfluous premium outpouring and prevents the business from handing over more cash to reimburse the business loan and its financing costs.

Be sure to know what the penalties are should you fail to pay

While it is great for any sort of business to reimburse business loans at the speediest length conceivable, there may be unavoidable conditions that make it incomprehensible for the business to reimburse on schedule or if nothing else for one installment period. For this reason, entrepreneurs ought to think about the punishments and accusations that happen on getting a business loan.

Keep an eye out for work in punishment conditions that might make it harder for organizations to address late installments because of the sheer sum expected to pay off in lieu of the missed installment time frame.

If so, this implies that missing a cutoff time may prompt heavier reimbursements for the business. Entrepreneurs should pay special attention to these statements and if conceivable, haggle with advanced specialists to make the punishments tolerable for the business.

Keep in mind the Processes on getting a business loan

Entrepreneurs ought to consistently evaluate on the off chance that the business loan they’re applying for is pressing or in any case. Small business loans have fluctuating handling times that rely upon the loan sort and the moneylender who will be supporting it.

Entrepreneurs are encouraged to talk with significant monetary figures all together for the business loan handling to be accelerated, contingent upon the criticalness of getting it.

It is essential to likewise acquire a rundown of the relative multitude of archives expected to apply for a business loan to cut down on handling time. Ensure that these archives are available prior to applying for the advance to forestall further postponements.

On the off chance that the business loan gets supported in the most limited measure of time conceivable, this means more freedom for the business to develop.

Find the best small business loans that fit your situation

Listed below are the different types of Small Business Loan:

A momentary business advance that has no security for the most part accompanies a limit of a year term. You’ll reimburse the advance and interest day by day, week after week or month to month. To get support, it is exceptionally quick and you should show the last 3 years of your bank articulations which the business loan specialist will use to decide your exchanging past.

Unsecured Business Loans are wonderful to pay for advertising, finance surprising costs, charge bills, or to subsidize other business needs. Applying for these advances, particularly online, is much faster than physical banks.

- Business finance loans

Australia’s 2 million SMEs utilize around 70% of the labor force, which is enormous by worldwide guidelines and practically every one of them needs business subsidizing in some structure. Absence of admittance to extra subsidizing was the most ordinarily announced obstruction to the turn of events or presentation of new or fundamentally further developed merchandise, administrations, cycles or strategies (17%)

Business funding supports every aspect of starting, running and growing a small business from cash flow lending, trade and supply funding and equipment finance. These can be accessed through online brokers or through traditional banks.

An overdraft office ordinarily has the ability to cover costs of doing business while income is being looked out for. This can be brought about via irregularity or exchanging terms given to clients. Little and additionally medium organizations or associations inside Australia are the fundamental providers of labor and products to 55% of Australian organizations.

Get financing for hardware in just two days from Australia’s driving non-bank business loan specialists at the most ideal rates and terms. The most widely recognized sort of obligation financing looked for by organizations was another advance with a term of over one year (37%), trailed by new capital/finance rent or recruit buy understanding (36%).

Typically, a business loan that can be repaid in less than 12 months is classified as short term. Businesses reported that the main reason for them seeking new short term loans is to maintain their cash flow and the liquidity of their business in the long run.

Indeed, even all those organizations can encounter troublesome occasions leaving a terrible credit blemish on their document; however that doesn’t really prohibit them from getting financing. A significant number of the non-bank loan specialists at ebroker will view a business with terrible acknowledgement as long as they can research the singular defaults.

- Trade finance

A Trade Finance office can be ideal since it very well may be unstable, remaining behind some other bank offices set up. This sort of independent company advance is otherwise called production network money or import finance. Make certain to investigate the expenses related with any exchange finance office. Apply for this sort of advance by entering your sum at the highest point of the page.

We referenced before that you really want to have a great deal of documentation to get supported. Sometimes a business has no archives of forward-thinking or they essentially don’t have the opportunity to give it all to the moneylenders; however that doesn’t mean an independent venture advance is not feasible. You will forever have to give the most recent half year bank proclamations to get supported for any Low Doc Business Loans.

On many events a credit extension business advance is great on the off chance that your requirements and sums fluctuate and the speedier you can settle the advance equilibrium the best unstable business advance rates you will get. Income is above all else and approaching this money can save your business in difficult spots.

- Invoice discounting

With receipt limiting, you can access up to 90% of the worth of your solicitations paid to you forthright. This kind of business finance is ideally suited for a business that offers terms of 3-90 days as you can utilize the solicitations as guarantee and let loose your everyday income issues. Apply for this sort of advance by entering your sum at the highest point of the page.

On many events, a credit extension business loan is great on the off chance that your requirements and sums fluctuate. The faster you can settle the advance equilibrium, the better unstable business loans rates you will get.

As an independent company you really want to do your examination. Probably the most effective way to investigate your choices is to channel through the numerous moneylenders that will offer you a business loan.

With so many choices available, it very well may be overpowering to get a small business loan. Be that as it may, assuming you assess your business needs, you can limit the choices. Then, at that point, do investigate on a couple of moneylenders to see what financing costs, expenses, loan sums and terms are advertised. This can assist you with tracking down the best finance option for your circumstance and get your business the cash it needs to succeed.

NEED FUNDING FOR YOUR BUSINESS? GET A FREE QUOTE TODAY AND GET FUNDED!

CLICK HERE TO GET A FREE QUOTE

Share this article